Used Motor Vehicle Valuation System Tanzania Revenue Authority (TRA) | TRA Used Motor Vehicle Valuation System Tanzania.

Get all info about Used Motor Vehicle Valuation System Tanzania Revenue Authority (TRA). This guide provides relevant information about TRA Calculator to let you find the information you need. Save time and get Used Motor Vehicle Valuation System by Tanzania Revenue Authority (TRA) details here at .

The Tanzania Revenue Authority is a government agency of Tanzania, charged with the responsibility of managing the assessment, collection and accounting of all central government revenue under commissioner general. It is a semi-autonomous body that operates in conjunction with the Ministry of Finance and Economic Affairs.

As a car owner or buyer in Tanzania, it is important to know the value of the import duty and taxes placed on different types of cars. This is where the Tratanzania Car Calculator comes in handy. It is an online tool that helps you calculate the import duty and taxes for various types of vehicles, including the tax club and vehicle registration, based on their year of make, engine capacity, and other factors. In this blog post, we will take you through the importance of the TRA calculator, how to access it, and a step-by-step guide to using it for cars in Tanzania, Uganda, and other African countries.

Importance of TRA calculator in Tanzania

The TRA calculator is a crucial tool for anyone looking to import a car into Tanzania or buy a car that has already been imported. The calculator allows you to estimate the amount of import duty and taxes that you will be expected to pay, based on the vehicle’s specifications. This helps you plan your budget accordingly and avoid any surprises when it comes to additional costs that may arise. The Car Calculator is also important because it helps the government of Tanzania ensure that the correct amount of taxes and duties are collected, thereby contributing to the country’s development.

How to Access the TRA calculator Online

The TRA calculator can be accessed online through the TRA website. Simply visit the TRA website and navigate to the ‘e-Services’ section. Under ‘e-Services’, select ‘TRA calculator‘ and follow the instructions that follow to access and use the tool. The TRA calculator and price list can be used by anyone, whether you are a car dealer, importer or an individual car owner.

Step-by-Step Guide to Using the TRA calculator

Using the TRA calculator is a simple process that can be broken down into the following steps:

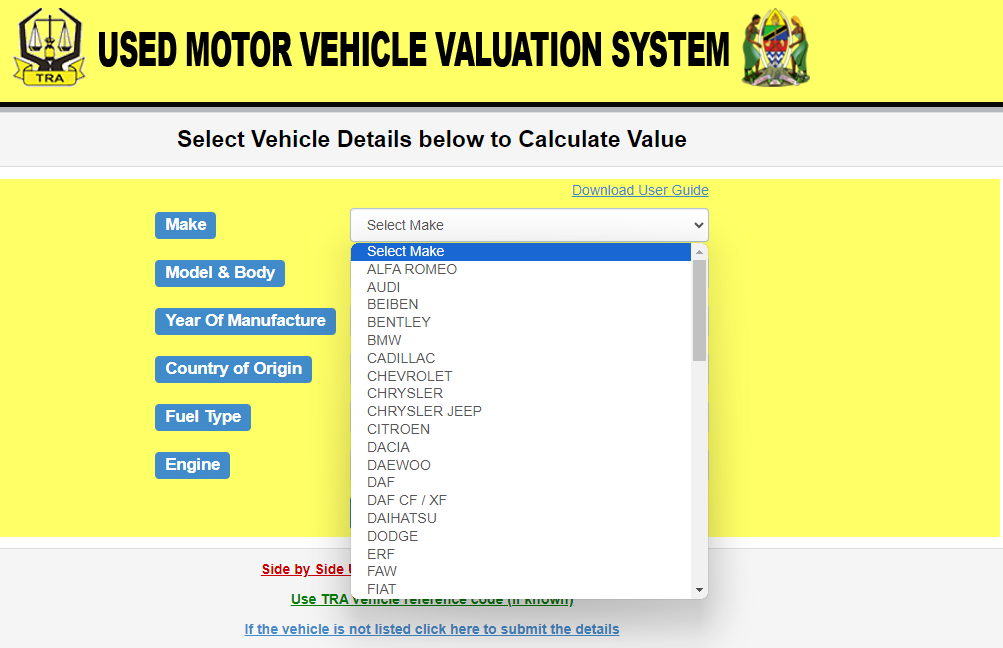

Selecting Vehicle Details for Calculation

The first step in using the TRA calculator is selecting the vehicle details for the calculation. This includes the make and model of the car, the year of make, engine capacity, and whether it is a new or used car. Once you have selected these details, click on ‘Calculate’ to proceed to the next step.

Navigating the Calculations and Results

Once you have clicked on ‘Calculate’, the TRA calculator will display the import duty, stamp duty, motor vehicle transfer tax, and other applicable taxes and fees for your vehicle based on the details you provided. This includes the Import Duty, Excise Duty, VAT, Infrastructure Levy, and Withholding Tax. You can navigate through the calculations and results by using the tabs that are displayed at the top of the page.

What if I Encounter Problems with the TRA calculator?

If you encounter any problems or issues while using the TRA calculator, you can get in touch with the TRA customer support team for assistance. They can be reached through their website or by calling the toll-free number that is displayed on the website.

CLICK HERE FOR: TRA Used Motor Vehicle Valuation System

Other TRA Calculators and Tools

READ ALSO: JOBS IN TANZANIA

Conclusion

The TRA calculator is an important tool that can be used by anyone looking to import or buy a car in Tanzania it shows also motor vehicle licence fee. It helps you avoid any surprises when it comes to import duty and taxes, and contributes to the development of the country by ensuring that the correct amount of taxes and duties are collected. By following the step-by-step guide provided in this blog post, you can easily access and use the TRA calculator to estimate the import duty and taxes for your vehicle.