Introduction to Capfin online loan

Life is full of unexpected occurrences that often require quick financial attention. Whether it’s a medical emergency, a critical home repair or education costs, these sudden expenses can throw even the most diligent budget planning off-track. In such scenarios, quick and easy financial assistance proves to be a lifesaver. This is where Capfin steps in. Offering transparent loan products and services devoid of hidden costs, it ensures you get what you’ve signed for, making loan management incredibly easy. Through Capfin online loan application process and a quick approval and disbursement system, borrowing from Capfin is straightforward and can be easily managed through your Capfin loan account.

Capfin loan Key Highlights

- Capfin offers easy-to-manage loans of up to R50,000 with no hidden costs and transparent loan products and services.

- The loan application process is simplified and can be completed online with Capfin.

- An affordability assessment process ensures customer interests are considered when granting a loan.

- Loan approval status can be checked online, with disbursements usually made within 48 business hours after approval.

- Capfin provides various options for repayment and DebiCheck services ensuring a secure debit order payment system.

- Besides loan services, Capfin also offers options for funeral cover.

Importance of a quick loan

A fast loan grant is crucial during emergencies as it provides immediate relief from monetary constraints. It becomes significantly meaningful when time is a vital factor, like medical exigencies. Quickness in processing not only assures ease but also brings in a certain level of convenience. With this in mind, Capfin delivers efficient banking service through its rapid loan procedures.

Capfin’s role in simplifying the loan application process

Capfin plays a significant role in simplifying this procedure, enabling customers to manage their loans without any difficulty. Once an application is submitted, our affordability assessment process evaluates the best interests of the customer considering their proof of income, thus ensuring a responsible lending practice. Our utmost priority is your financial well-being.

Capfin online loan application application Process

Applying for a loan with Capfin is quick and straightforward. It involves providing required information, document submission, and completing the application. You can choose to apply online or via SMS, or you can visit any PEP or Ackermans store across the country.

Capfin loan Required information and documents

Before initiating the application process, it’s essential to have the following:

- Your SA ID proving that you are a South African resident.

- Proof of permanent employment and monthly salary.

- Your latest three payslips or three bank statements showing your income.

- A legitimate cell phone number.

- A valid SA bank account.

Remember that the above-listed documents need to be up-to-date to proceed without interruption.

How to apply Capfin online loan application

To apply for an online loan with Capfin, follow these steps:

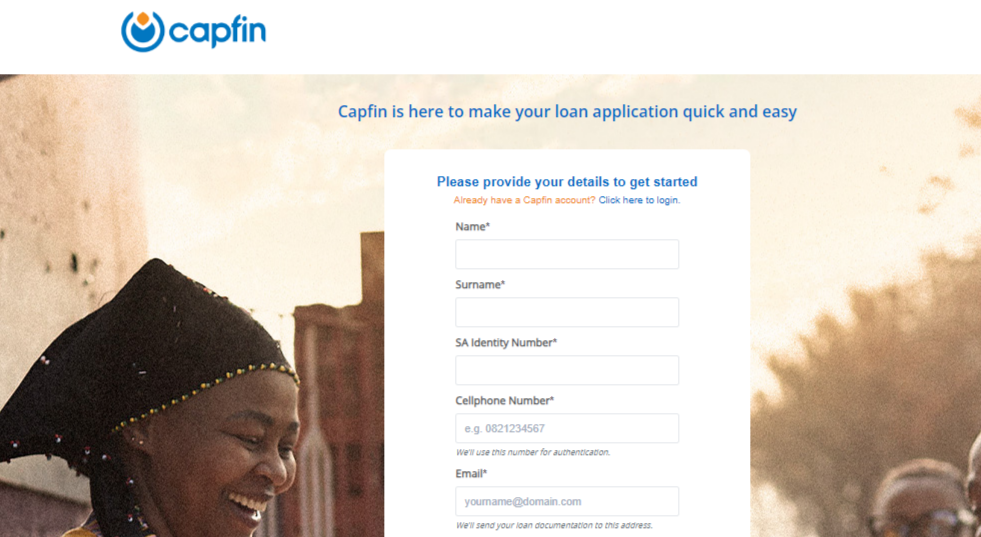

1. Visit the Capfin website at

2. Fill in your name, surname, SA Identity Number, cellphone number, and email address in the provided fields.

3. Make sure to provide accurate information as it will be used for authentication purposes.

4. Once you have filled in all the required details, click on the “Submit” button to complete your application.

5. After submitting your application, Capfin will review your information and assess your eligibility for a loan.

6. If approved, you will receive further instructions on how to proceed with the loan process.

Remember to carefully read and understand all the terms and conditions before applying for a loan.

Security of Capfin’s online loan application

Capfin ensures complete security of your personal and financial information during the online application process. The system uses state-of-art encryption algorithms to safeguard your details. Moreover, applicants are authenticated through their SA ID numbers and a unique one-time-pin (OTP) sent to the registered cell number. This guarantees protection against potential security threats.

Loan Approval and Disbursement

Following your application, Capfin’s credit and affordability assessment process takes place. After approval, the loan amount gets disbursed to your nominated bank account generally within 48 business hours, ensuring you receive your funds promptly and efficiently.

Capfin loan Checking loan approval status

You can quickly check the status of your loan anytime post-application. By logging in to the Capfin website and entering your SA ID number, you can track the progress of your application. It’s a simple and convenient way to remain updated about your loan approval status.

Capfin Pay-out duration

Once the loan is approved, the disbursement happens swiftly. The amount is paid out to your nominated bank account. This process typically occurs within 48 business hours after approval. Here’s an overview of the loan pay-out duration:

|

Loan Approval |

Pay-out Duration |

|

Approved |

Within 48 business hours |

Capfin loan Repayment

Capfin makes loan repayment flexible and comfortable to manage. With various options for payment and a clearly outlined repayment schedule, borrowers find it easy to plan their finances accordingly. Consistent repayments also contribute positively to a borrower’s credit rating.

Loan terms and monthly instalments

With Capfin, customers can choose from 6 or 12 month loan repayment terms. The monthly instalments depend on the loan amount and the term. The maximum interest rate, initiation fee, service fee, and Capfin Credit Life are all factored into the instalment. Here’s a brief overview to provide you with an understanding of how it works:

|

Loan Term |

Loan Amount R |

Max Interest Rate % pm |

Max Total Loan Repayment R |

|

6 Months |

8000 |

5.00% |

11890.64 |

|

12 Months |

8000 |

3.00% |

9823.04 |

Dealing with non-payment situations

Non-payment not only impacts your credit record negatively but may also attract additional interests or fees. Hence, it is essential to maintain consistency in repayment. In case you face difficulty in adhering to your payment schedule, reach out to Capfin’s Collections Department to discuss possible alternative payment arrangements. Proactivity can help mitigate potential consequences of non-payment.

Capfin loan Making changes to payment details

On occasion, a change in your debit order pay date or bank account might become necessary. To facilitate these changes, log into your online profile and update the necessary details or use our USSD facility *134*6454# to make the change. Alternatively, you could call the Capfin contact centre to make the required change. Please note that such a change may require you to approve a DebiCheck Authentication message from your bank.

Conclusion

The need for rapid and easy financial support is universal, particularly during unexpected events. Capfin, understanding this requirement, offers simple, transparent loan services with no hidden costs. Ensuring the security of your financial data, it simplifies the loan application procedure, making it uncomplicated and less time-consuming. From your loan application till disbursement, and further to repayment, each step is strategically designed to suit customers’ needs. Moreover, strong customer service ensures that any alterations required during the repayment process are catered to. Furthermore, Capfin provides financial protection instatement, the DebiCheck to secure debit orders and the Funeral Cover to financially aid in unfortunate circumstances. In conclusion, Capfin stands out as a dependable, secure, and supportive financial institution, ensuring that whenever you require help financially, there’s always a helping hand extended towards you.

Frequently Asked Questions

How do I qualify for a Capfin loan?

To qualify, you must be 18 years or older and a resident of South Africa. You should have a valid SA ID, be permanently employed, have a monthly salary, a valid cell phone number, and a valid SA bank account.

Does Capfin perform credit checks?

Yes, as part of the application process, Capfin will conduct credit checks along with an affordability assessment to ensure responsible lending.

What is the maximum loan amount I can apply for?

The maximum loan amount at Capfin is R50,000. However, the actual amount granted depends on your income statement, expenses, credit profile, and the outcome of the affordability assessment.

How can I submit my required documents?

You can easily upload your documents during your online application on the Capfin website or alternatively email or send via fax. At some banks, Capfin can retrieve your documents directly with your permission.